Moderna director Noubar Afeyan sells over $1.6m in company stock

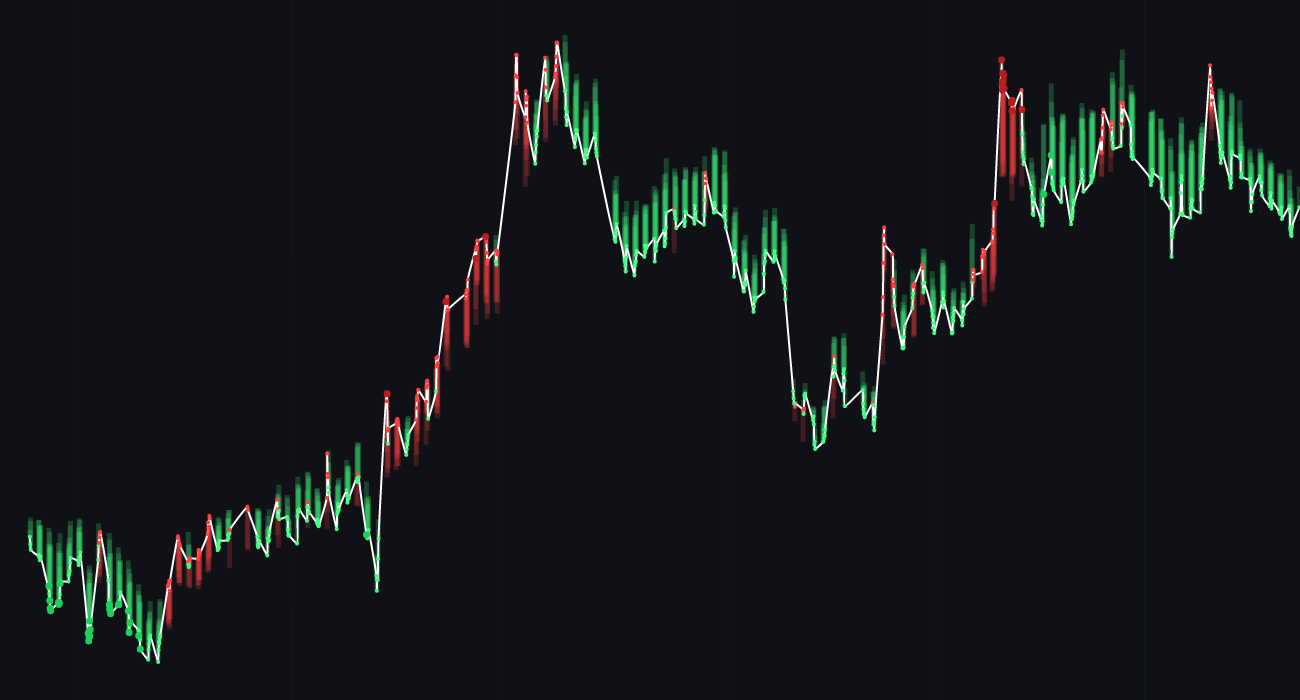

Moderna, Inc. (MRNA) stock is expected to decrease by 3.0% in the short-term 🟥, but increase by 1.6% in the long-term 🟢.

Stock AI’s (MRNA) Forecast get (+24.3% Profit)

StockAI’s analysis delivers real-world results. On 02 January 2024, $MRNA ($114.59), StockAI predicted a long-term 🔴 sell signal. It was accurate: 1 month later price dropped to $86.8 (🔴-24.3%). Selling MRNA on this signal yielded a +24.3% profit 💰💰.

MRNA-Moderna, Inc. News

🔴 Moderna Director Noubar Afeyan sold 15,000 shares at an average price of $109.06, totaling $1,635,900.00.

🔴 Pacer Advisors Inc. trimmed its holdings in Moderna by 14.9% in the 4th quarter.

🟢 Livforsakringsbolaget Skandia Omsesidigt lessened its stake in Moderna by 84.1% during the 4th quarter.

🟢 Moderna President Stephen Hoge sold 15,000 shares at an average price of $105.02, totaling $1,575,300.00.

🔴 Daiwa Securities Group Inc. raised its holdings in Moderna by 5.3% in the 4th quarter.

🔴 Moderna shares fell 3.7% during trading on Wednesday.

Moderna, Inc. (MRNA) has been facing a series of negative news in recent times, including key insiders selling significant amounts of shares and institutional investors trimming their holdings. These actions have put downward pressure on the stock price, with shares falling 3.7% during trading on Wednesday.

The sales by Director Noubar Afeyan and President Stephen Hoge have raised concerns among investors, leading to a decrease in confidence in the company. Additionally, the trimming of holdings by Pacer Advisors Inc. and Daiwa Securities Group Inc. further contributed to the negative sentiment surrounding the stock.

On the flip side, the decrease in stake by Livforsakringsbolaget Skandia Omsesidigt may indicate a lack of confidence in Moderna’s long-term prospects. This, coupled with the overall bearish sentiment in the market, has led to a short-term forecast of a 3.0% decrease in the stock price.

In the long term, however, there may be a glimmer of hope as the company continues to make progress on its next-gen COVID-19 vaccine pipeline. This could potentially lead to a 1.6% increase in the stock price over time. Investors will need to closely monitor any developments in Moderna’s vaccine pipeline to gauge the impact on the stock price.

MRNA-Moderna, Inc. Analyst Ratings

Analyst Ratings for Moderna, Inc. Stock:

📈 Needham & Company LLC reiterated their hold rating on shares of Moderna (NASDAQ:MRNA) in a recent research report.

📉 William Blair maintained a market perform rating on Moderna (NASDAQ:MRNA) stock.

📈 Jefferies Financial Group gave Moderna (NASDAQ:MRNA) a buy rating in their latest research note.

Sources:

1. ETFDailyNews – Needham & Company LLC Rating

2. ETFDailyNews – William Blair Rating

3. ETFDailyNews – Jefferies Financial Group Rating

Disclaimer

Investors may consider the AI predictions and news summaries as one factor in their investment decisions alongside their own research and risk tolerance.