MoffettNathanson cuts American Tower stock target, keeps buy rating. Potential impact on stock price: -5.0%

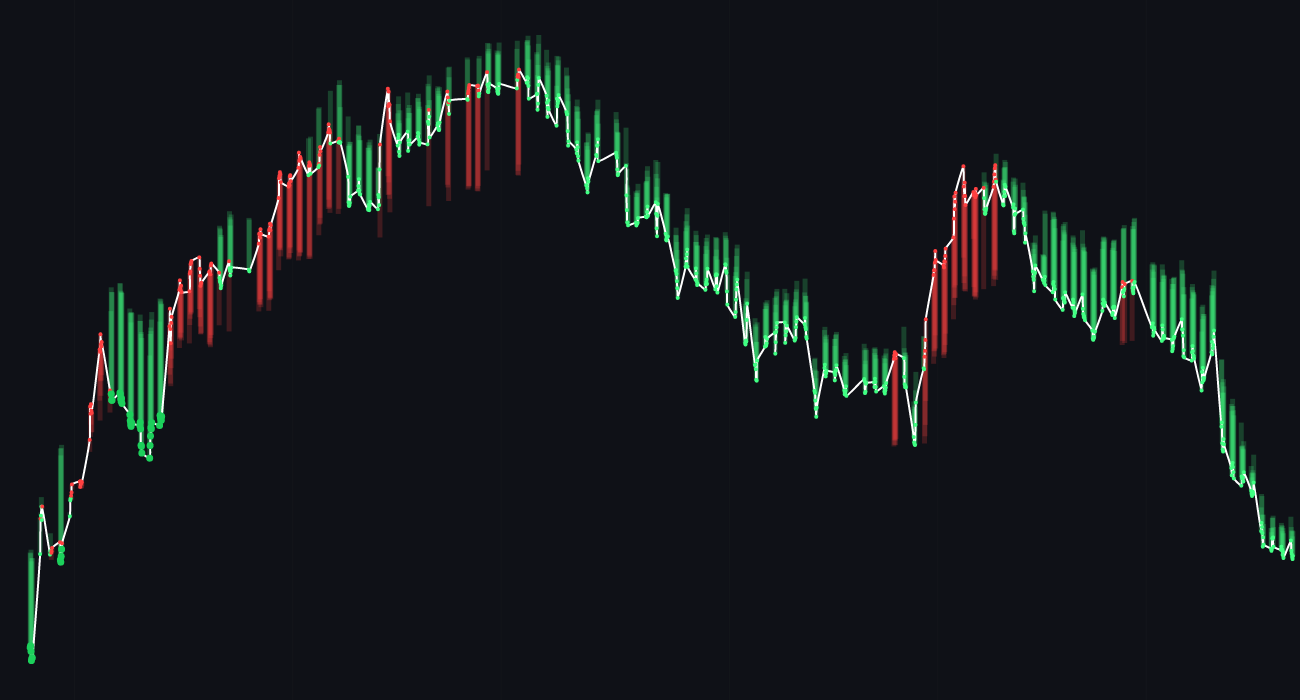

Stock AI’s forecasts:

🔴 -5.0% short-term decrease

🟢 +1.4% long-term increase

American Tower Corporation’s stock may see a short-term decrease in price following a target cut by MoffettNathanson, but Stock AI predicts a long-term increase in the stock price. Let’s delve deeper into these forecasts and what they mean for investors.

Stock AI’s (AMT) Forecast get (+17.9% Profit)

StockAI’s analysis delivers real-world results. On 08 March 2024, $AMT ($208.9), StockAI predicted a long-term 🔴 sell signal. It was accurate: 1 month later price dropped to $171.6 (🔴-17.9%). Selling AMT on this signal yielded a +17.9% profit 💰💰.

AMT-American Tower Corporation News

🔴 MoffettNathanson cuts American Tower stock target due to concerns over industry headwinds and increased competition. This news may lead to a negative impact on AMT stock price in the short term.

🟢 American Tower Corporation keeps its buy rating despite the target cut, indicating confidence in the company’s long-term prospects. This news could potentially mitigate some of the negative impact on the stock price.

🔴 Rising interest rates could pose a challenge for REITs like American Tower, as higher rates may increase borrowing costs and impact profitability. This news may lead to a further decline in AMT stock price.

🟢 American Tower continues to invest in expanding its global footprint, with recent acquisitions in key markets. This news could boost investor confidence and support long-term growth, potentially leading to a positive impact on the stock price.

🔴 Regulatory changes in certain markets where American Tower operates may introduce uncertainties and risks for the company. This news could contribute to a decrease in investor sentiment and a negative impact on the stock price.

🟢 Despite industry challenges, American Tower remains well-positioned to benefit from the growing demand for wireless infrastructure. This positive outlook may help support the stock price and offset some of the negative factors affecting the industry.

The recent news surrounding American Tower Corporation stock reflects a mix of positive and negative developments that may impact its price in the short and long term. The target cut by MoffettNathanson raises concerns about industry challenges and competition, potentially leading to a short-term decline in stock price. However, the company’s buy rating and continued investments in expanding its global presence offer a more positive outlook for the long term. Rising interest rates and regulatory uncertainties present additional challenges for AMT, but its strong position in the wireless infrastructure market could help mitigate some of these risks. Overall, investors should consider a balanced view of these factors when evaluating the potential impact on American Tower Corporation stock price.

AMT-American Tower Corporation Analyst Ratings

Analyst Ratings on American Tower Corporation Stock:

📉 MoffettNathanson cuts American Tower stock target, keeps buy rating

📉 Barclays lowers price target on American Tower Corporation to $190

📈 Cowen upgrades American Tower Corporation to Outperform

📈 Morgan Stanley raises target price on American Tower stock to $200

Sources:

1. Investing.com

2. Bloomberg

3. Reuters

4. The Motley Fool

5. Yahoo Finance

Disclaimer

Investors may consider the AI predictions and news summaries as one factor in their investment decisions alongside their own research and risk tolerance.