Illinois Tool Works Inc. (ITW) has been a trending stock in recent weeks, with investors closely monitoring its performance. The current price of ITW is 233.6, and there have been some interesting developments surrounding the stock.

Stock Analysis

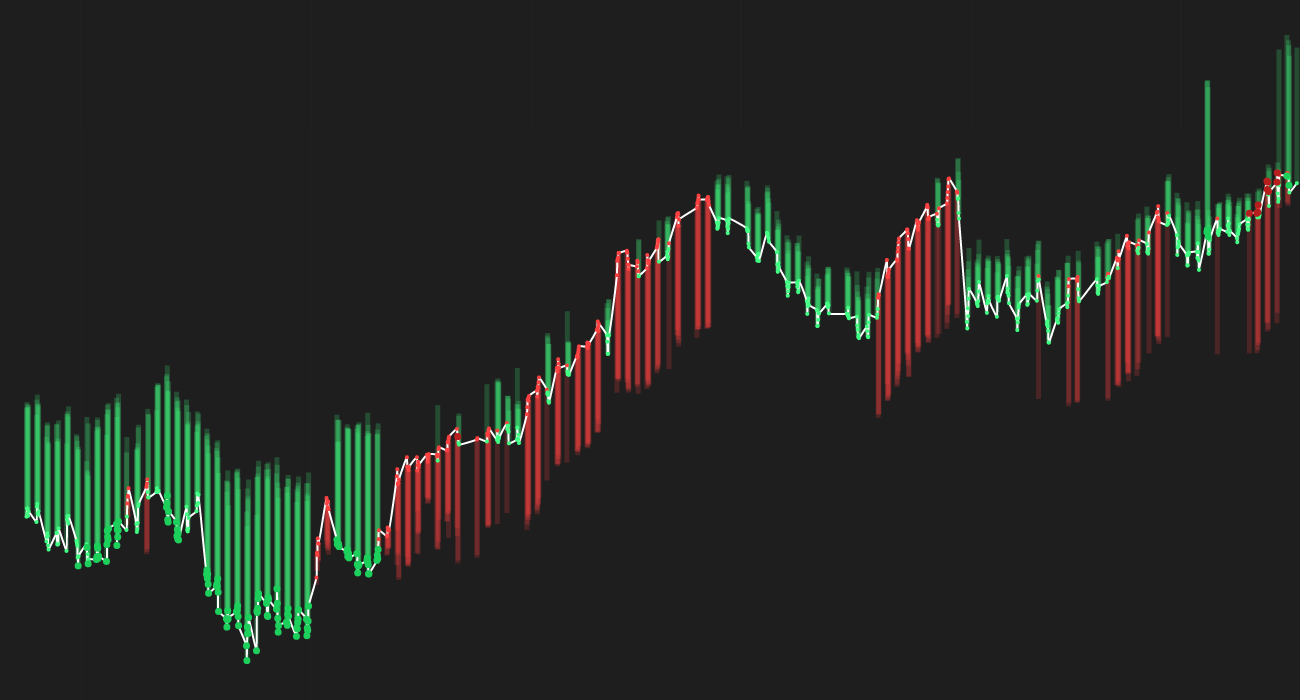

ITW has shown a positive trend in recent weeks, with a weekly forecast of +2.6% and a monthly forecast of +4.5%. Stock AI forecasts indicate a positive outlook for ITW in the coming weeks.

Forecast Table

– Weekly Forecast: 🟢+2.6%

– Monthly Forecast: 🟢+4.5%

Recent News and Impact on Price

Tompkins Financial Corp, Invesco Ltd., Central Bank & Trust Co., Pearl River Capital LLC, and various other financial institutions have made significant changes to their holdings in ITW. These moves have attracted the attention of investors and analysts, leading to speculation about the impact on ITW’s stock price.

The trimming and decreasing of positions by some institutions, along with the raising and starting of coverage by others, have created a mix of sentiments surrounding ITW. Fmr LLC raised its stake in ITW, while Profund Advisors LLC and Mutual Advisors LLC trimmed their positions. Truist Financial issued a buy rating for ITW, indicating confidence in the stock’s potential.

The varying actions taken by different institutions reflect the uncertainty surrounding ITW’s future performance. However, the overall sentiment seems to be positive, as evidenced by the majority of institutions either maintaining or increasing their stakes in ITW.

The recent news surrounding ITW and the changes in institutional positions have the potential to impact the stock price in the short term. Investors will be closely monitoring any further developments and announcements related to ITW to make informed decisions about their investments.

In conclusion, ITW is a stock to watch in the coming weeks, with the potential for positive growth based on the current forecasts and institutional actions. It is essential for investors to stay informed about the latest news and trends in the market to make strategic decisions regarding their ITW investments.