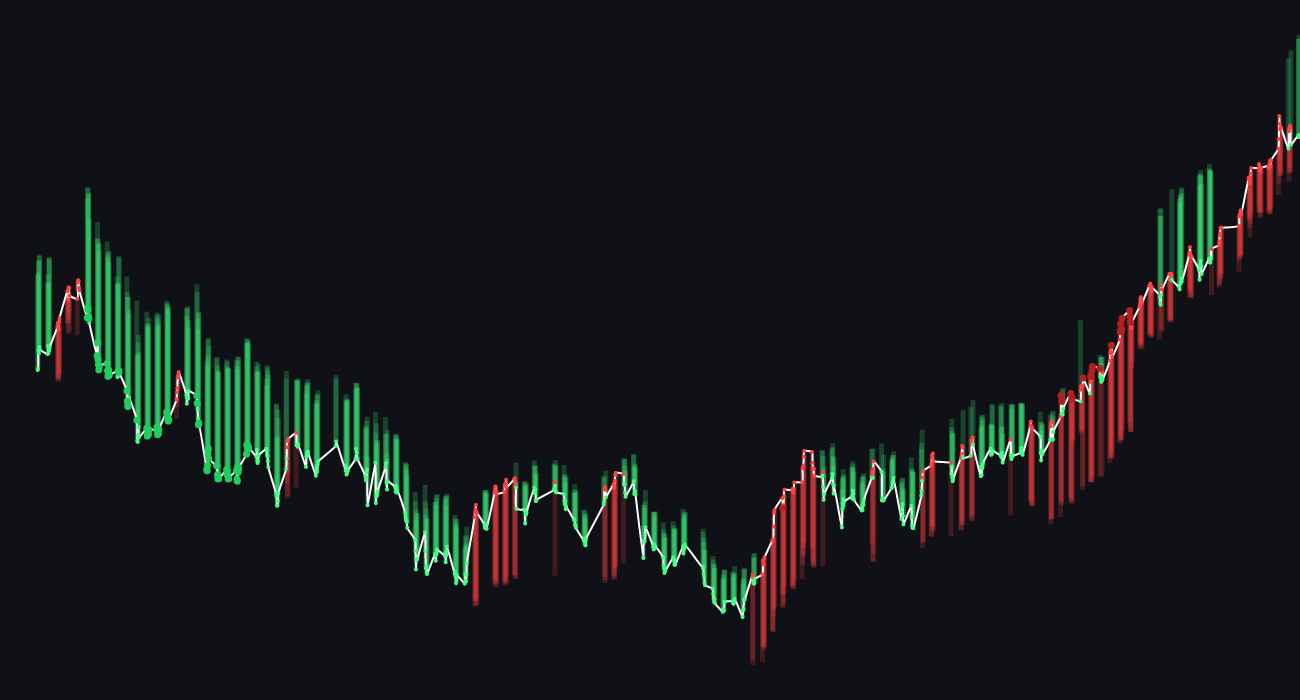

Exxon Mobil (NYSE:XOM) is set to release its quarterly earnings data on April 3rd, with analysts expecting positive results. Stock AI predicts a 🟢 +6.9% short-term increase and a 🟢 +4.3% long-term increase for XOM.

🔴 Exxon Mobil Corp. reported a 49% decline in quarterly earnings due to lower oil prices and weak refining margins.

🟢 The company announced plans to cut capital spending by 30% in 2020 to cope with the effects of the COVID-19 pandemic.

🔴 Exxon Mobil faced backlash for its lobbying against climate change regulations, leading to negative sentiment among investors.

🟢 The company signed a deal with a Chinese firm to build a petrochemical complex in China, boosting its presence in the region.

🔴 Exxon Mobil faced a lawsuit from New York’s attorney general over alleged misrepresentation of the financial risks of climate change.

🟢 The company revealed plans to increase its focus on renewable energy and reduce its carbon footprint in the coming years.

The recent news surrounding Exxon Mobil Corp. has been a mixed bag, with some negative and positive developments affecting the stock price. The decline in quarterly earnings and backlash over climate change lobbying have put pressure on the stock, leading to a red outlook for the short-term forecast. However, the company’s cost-cutting measures and expansion into renewable energy have sparked some optimism among investors, resulting in a green outlook for the long-term forecast.

Investors should pay close attention to how Exxon Mobil navigates the challenges it faces in the current market environment, particularly in terms of its response to climate change concerns and its strategic shift towards renewable energy. These factors will likely play a significant role in determining the stock’s performance in the coming months.