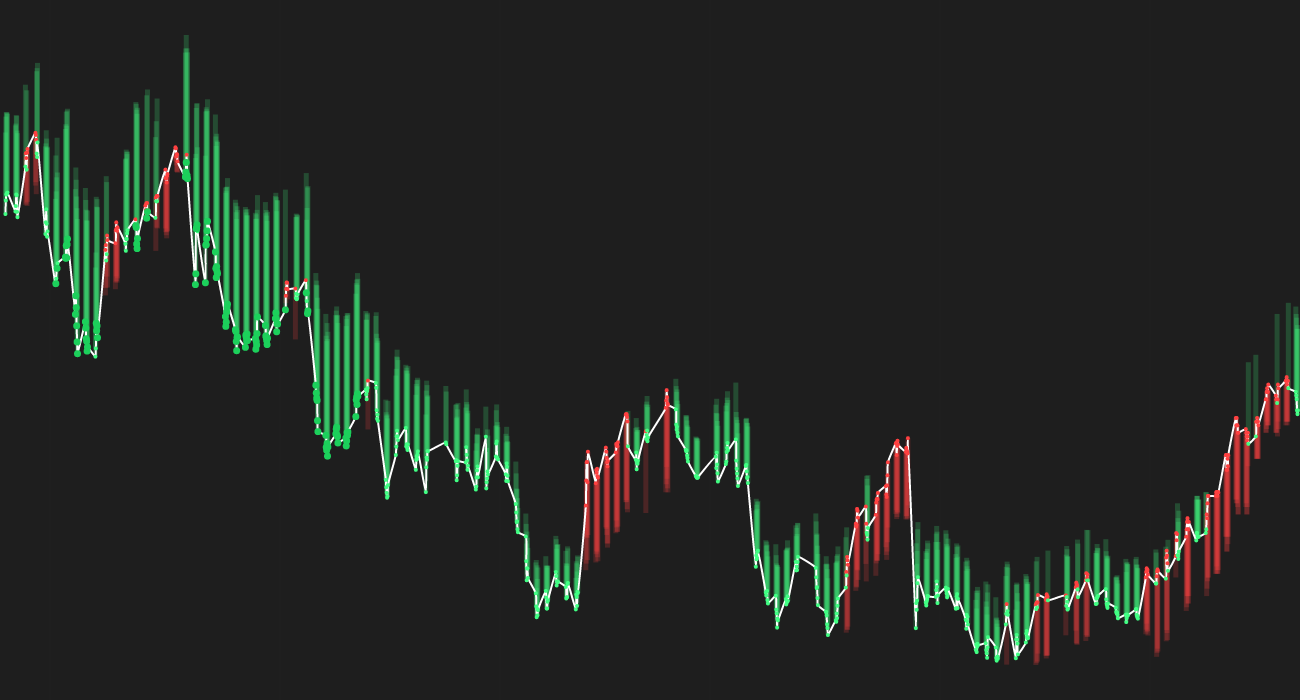

SLB-Schlumberger Limited has shown a positive trend recently, with the current price at 59.1. Analysts are closely monitoring the stock, analyzing the latest news and updates to predict possible outcomes for investors.

Forecast Table:

– Weekly Forecast: 🟢(+4.7%)

– Monthly Forecast: 🟢(+3.7%)

Recent News:

🔴 Schlumberger Limited CFO Stephane Biguet sold 6,250 shares of the business’s stock, raising questions about the company’s financial health.

🔴 Bartlett & Co. LLC decreased its position in Schlumberger Limited, indicating potential concerns about future performance.

🟢 Nordea Investment Management AB raised its holdings in shares of Schlumberger Limited, showing confidence in the company’s growth prospects.

🟢 Schlumberger Limited has earned a consensus recommendation of “Buy” from research firms, signaling positive sentiment in the market.

🔴 Schlumberger Limited EVP Abdellah Merad sold 50,000 shares of the firm’s stock, causing some uncertainty among investors.

🟢 Mercer Global Advisors Inc. ADV grew its position in shares of Schlumberger Limited, indicating a positive outlook for the company’s future.

🔴 Mutual Advisors LLC purchased a new stake in Schlumberger Limited, potentially signaling a lack of confidence in the stock.

🟢 Montecito Bank & Trust increased its position in Schlumberger Limited, suggesting a bullish sentiment towards the company.

🟢 Epoch Investment Partners Inc. boosted its holdings in shares of Schlumberger Limited, showing faith in the stock’s long-term growth potential.

🟢 Central Bank & Trust Co. grew its position in Schlumberger Limited, indicating confidence in the company’s future performance.

🔴 Sunbelt Securities Inc. trimmed its holdings in shares of Schlumberger Limited, potentially reflecting concerns about the stock.

🔴 Clearbridge Investments LLC decreased its holdings in shares of Schlumberger Limited, suggesting a lack of enthusiasm for the stock.

🟢 Schlumberger’s stock had its “buy” rating restated by analysts at Benchmark, indicating positive sentiment towards the company’s future.

🔴 Wesbanco Bank Inc. decreased its holdings in Schlumberger Limited, potentially signaling doubts about the stock’s performance.

🟢 Cary Street Partners Investment Advisory LLC boosted its holdings in Schlumberger Limited, suggesting confidence in the company’s growth prospects.

🟢 LPL Financial LLC raised its position in shares of Schlumberger Limited, indicating a positive outlook for the stock.

🟢 Envestnet Asset Management Inc. lifted its stake in shares of Schlumberger Limited, showing confidence in the company’s future growth.

🟢 AQR Capital Management LLC lifted its holdings in shares of Schlumberger Limited, indicating positive sentiment towards the stock.

🔴 Acadian Asset Management LLC trimmed its holdings in Schlumberger Limited, potentially reflecting concerns about the stock’s performance.

🔴 Symmetry Partners LLC lessened its holdings in Schlumberger Limited, indicating potential doubts about the stock.

🟢 Mercer Global Advisors Inc. ADV boosted its stake in Schlumberger Limited, showing confidence in the company’s future prospects.

🟢 Teza Capital Management LLC lowered its holdings in Schlumberger Limited, potentially reflecting a strategic shift in their investment portfolio.

🔴 Griffin Securities issued Q1 2025 earnings estimates for shares of Schlumberger, which could impact investor sentiment.

In conclusion, the recent news surrounding Schlumberger Limited stock has been mixed, with some positive developments and some concerns. Investors should carefully consider these factors and conduct thorough research before making any investment decisions. The market sentiment towards SLB appears to be cautiously optimistic, with a potential for growth in the near future.