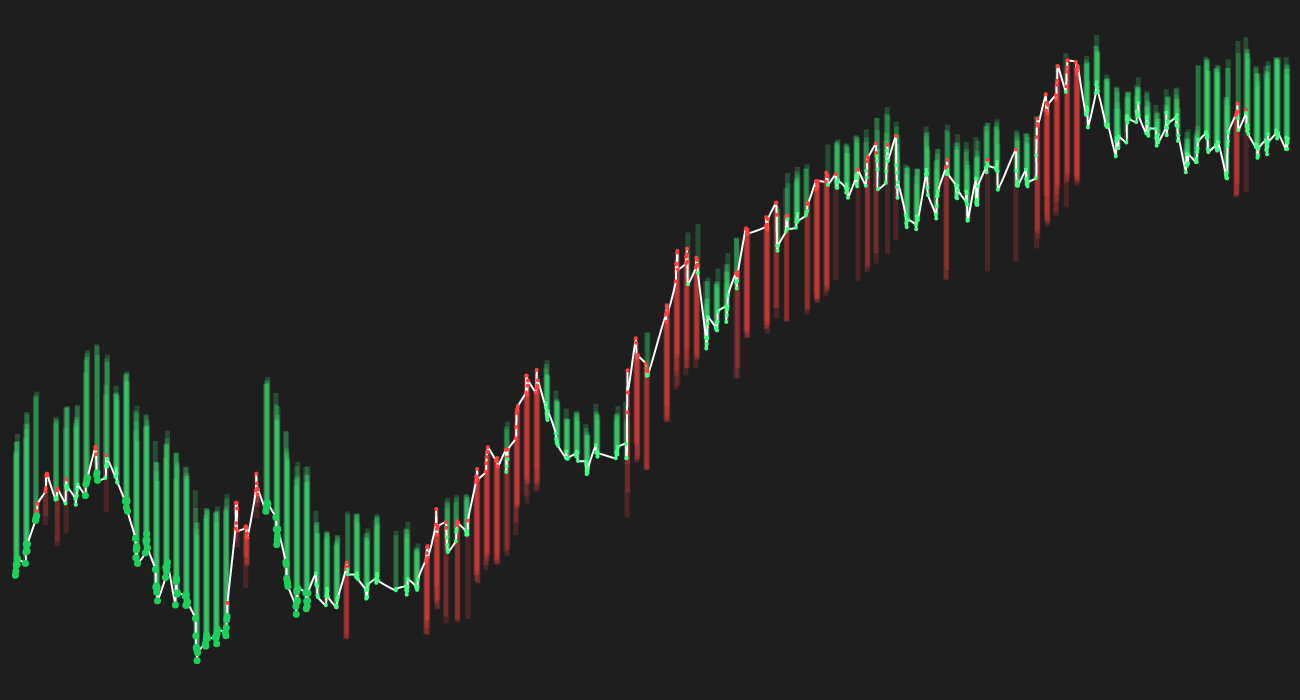

REGN-Regeneron Pharmaceuticals, Inc. has been showing a positive trend recently, with the current price at $802.0. The stock has seen a weekly forecast of (+6.4%) and a monthly forecast of (+5.6%).

🟢 Truist Financial reaffirmed their buy rating on shares of Regeneron Pharmaceuticals in a recent report, with a price target of $1,135.00, indicating positive sentiment towards the stock.

🔴 Central Bank & Trust Co. trimmed its position in Regeneron Pharmaceuticals by 6.0% in the fourth quarter, which could potentially signal a lack of confidence in the stock.

🟢 Scotia Capital Inc. acquired a new stake in Regeneron Pharmaceuticals during the third quarter, showing increased interest in the company.

🔴 Regeneron Pharmaceuticals EVP Joseph J. Larosa sold 1,000 shares of stock, which could lead to a short-term dip in the stock price.

🟢 Regeneron Pharmaceuticals has received an average rating of “Moderate Buy” from twenty-five brokerages, indicating positive sentiment from analysts.

In recent news, Regeneron Pharmaceuticals has seen a mix of positive and negative developments that could impact the stock price. While Truist Financial’s reaffirmation of a buy rating and the acquisition of a new stake by Scotia Capital Inc. are positive indicators, the trimming of positions by Central Bank & Trust Co. and the insider selling by EVP Joseph J. Larosa could potentially lead to some short-term volatility in the stock price.

Investors should closely monitor these developments and consider the overall trend of positive analyst sentiment towards Regeneron Pharmaceuticals. The stock has shown resilience in the face of recent challenges and could continue to see growth in the long term. While short-term fluctuations may occur, the overall outlook for REGN remains positive.