Beverly Hills Private Wealth LLC purchased a new stake in Rogers Communications Inc., potentially impacting the stock price.

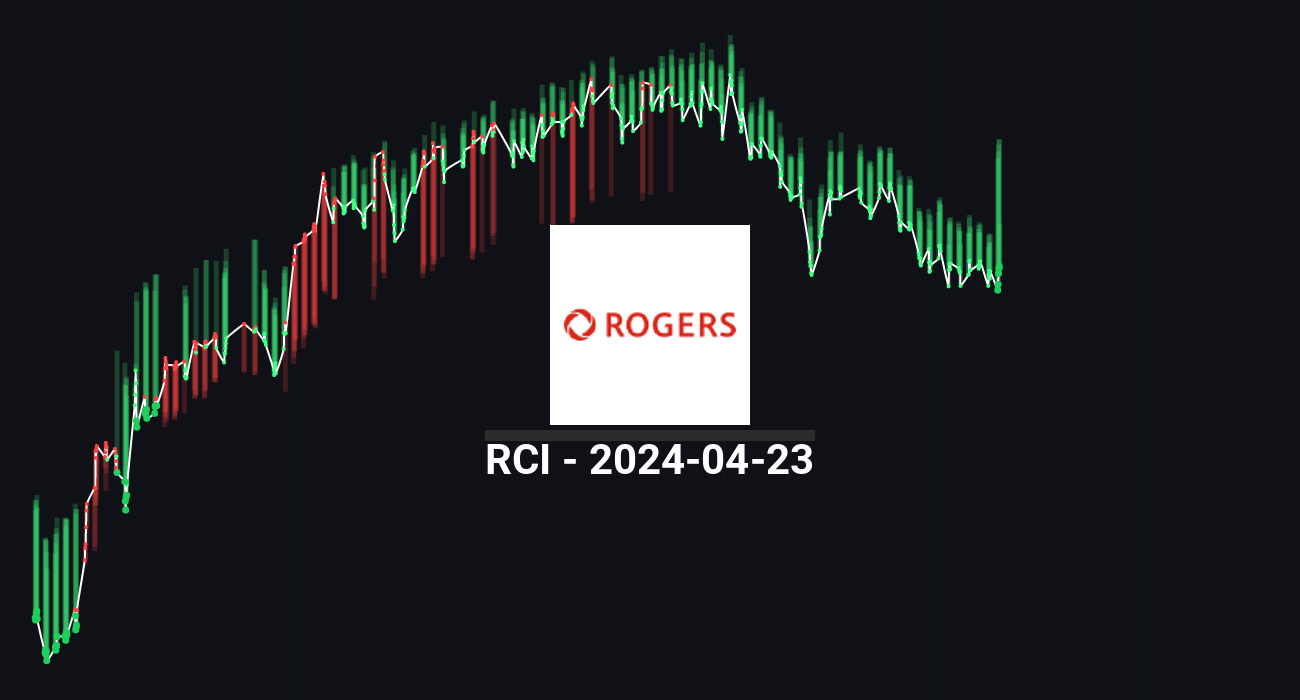

Stock AI’s forecasts:

🔴 -9.5% short-term

🟢 +1.7% long-term

Stock AI’s (RCI) Forecast get (+17.4% Profit)

StockAI’s analysis delivers real-world results. On 08 November 2023, $RCI ($39.6), StockAI predicted a long-term 🟢 buy signal. It was accurate: 1 month later price increased to $46.48 (🟢17.4%). Buying RCI on this signal yielded a +17.4% profit 💰💰.

RCI-Rogers Communications Inc. News

🟢 Beverly Hills Private Wealth LLC purchased a new stake in Rogers Communications Inc., showing confidence in the company’s future growth potential.

🔴 Cormark reduced their FY2024 earnings per share (EPS) estimates for Rogers Communications, leading to a negative outlook on the stock.

🟢 Raymond James & Associates increased its stake in Rogers Communications, signaling continued interest from institutional investors.

🔴 Everett Harris & Co. CA cut its position in shares of Rogers Communications, potentially indicating concerns about the company’s performance.

🔴 DekaBank Deutsche Girozentrale lowered its position in Rogers Communications, suggesting a lack of confidence in the stock.

🔴 National Bank Financial dropped their FY2024 earnings per share (EPS) estimates for Rogers Communications, adding to the negative sentiment surrounding the stock.

Rogers Communications Inc. has experienced a mix of positive and negative news recently, which has contributed to uncertainty in the market. The purchase of a new stake by Beverly Hills Private Wealth LLC may have initially boosted confidence in the stock, but this positive sentiment was countered by the reduction in earnings estimates by Cormark and National Bank Financial. Institutional investors like Raymond James & Associates showed continued interest in the company, while others, such as Everett Harris & Co. CA and DekaBank Deutsche Girozentrale, reduced their positions.

These conflicting signals have led to a short-term forecast of a 9.5% decrease in the stock price. However, the long-term forecast remains more optimistic, with a potential 1.7% increase. Investors should closely monitor developments within the company and the market to make informed decisions about their investments in Rogers Communications Inc.

RCI-Rogers Communications Inc. Analyst Ratings

Analyst Ratings:

📉 Cormark reduced their FY2024 earnings per share (EPS) estimates for Rogers Communications Inc.

📉 National Bank Financial dropped their FY2024 earnings per share (EPS) estimates for Rogers Communications Inc.

📈 Raymond James & Associates increased its stake in Rogers Communications Inc.

Sources:

1. ETF Daily News

2. ETF Daily News

3. ETF Daily News

4. ETF Daily News

5. Market Screener

Disclaimer

Investors may consider the AI predictions and news summaries as one factor in their investment decisions alongside their own research and risk tolerance.