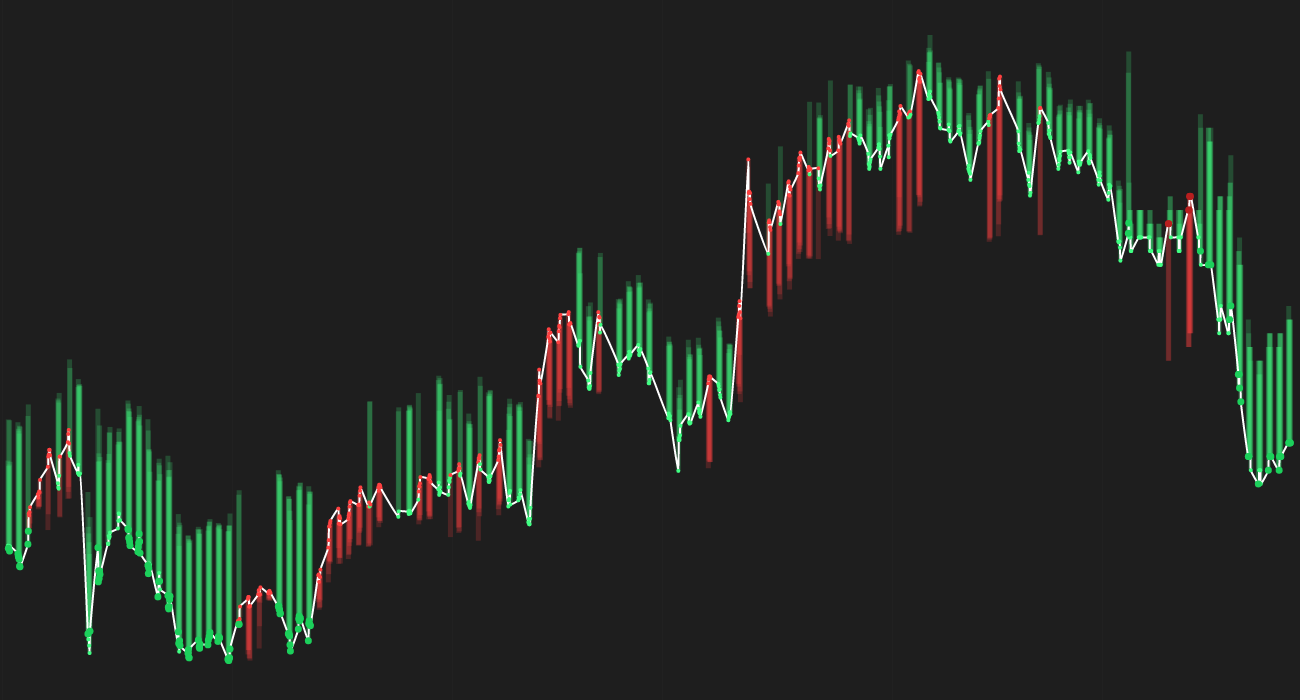

INFY-Infosys Limited has been holding steady in recent weeks, with the current price at 17.1. The stock has a weekly forecast of -0.2% and a monthly forecast of +3.6%.

🔴 Infosys Limited has earned an average rating of “Hold” from analysts covering the company, according to Marketbeat Ratings reports.

🔴 Sei Investments Co. has lessened its holdings in Infosys Limited by 8.8% in the third quarter.

🔴 Deutsche Bank AG raised its position in shares of Infosys Limited by 1.9% in the third quarter.

🔴 Royal London Asset Management Ltd. increased its stake in Infosys Limited by 97.3% in the third quarter.

🟢 Infosys was upgraded by StockNews.com from a “hold” rating to a “buy” rating.

🟢 Glenmede Trust Co. NA boosted its stake in shares of Infosys Limited by 10.1% during the 3rd quarter.

🟢 Stock analysts at Guggenheim initiated coverage on shares of Infosys.

🔴 Infosys Limited was the recipient of unusual options trading with an increase in put options.

🔴 Infosys was downgraded by StockNews.com from a “buy” rating to a “hold” rating.

The recent news surrounding Infosys Limited stock indicates a mixed sentiment among analysts and investors. While there have been some downgrades and decreases in holdings, there have also been upgrades and increases in stake. The average rating of “Hold” may indicate a cautious outlook on the stock.

The increase in put options could suggest some bearish sentiment among investors, while the initiation of coverage by Guggenheim could bring in some new interest in the stock. The overall impact of these news events on the stock price remains to be seen, but it is clear that there is a range of opinions on the future performance of Infosys Limited.

Investors should continue to monitor the stock closely and consider the potential impact of these news events on their investment decisions. The stock may experience some volatility in the near future as the market digests the various analyst ratings and actions taken by institutional investors.