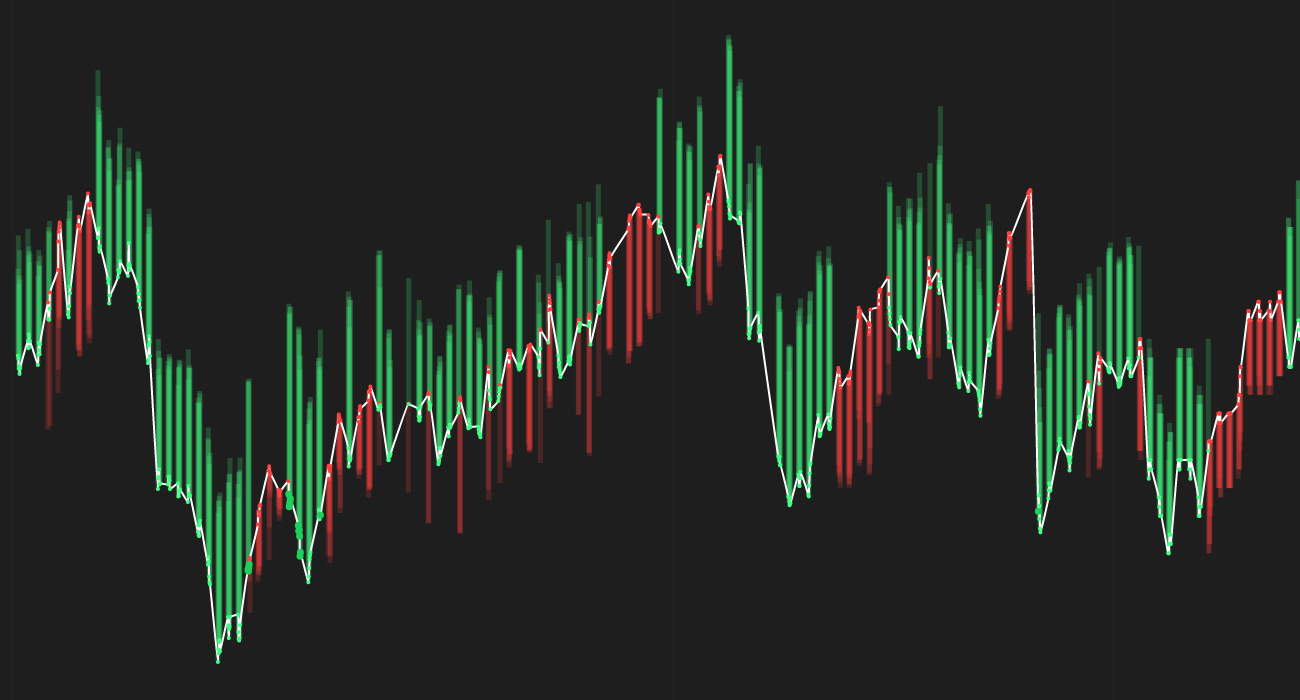

HSBC Holdings plc (HSBC) has been showing some interesting trends recently, with the current price standing at 39.1. The long-term forecast for HSBC is +2.4% and the short-term forecast is +4.3%.

🔴 Dubai is seeking to raise as much as 1.57 billion dirhams ($429 million) from the initial public offering of the city’s public-parking business, which could impact investor sentiment in the United Arab Emirates.

🟢 HSBC Holdings plc insider Noel Quinn sold 89,546 shares of the firm’s stock, which could signal confidence in the company’s performance.

🟢 HSBC Holdings PLC issued senior unsecured notes, which could indicate a positive outlook on the company’s financial health.

The recent news surrounding HSBC Holdings plc has the potential to impact the stock price in both positive and negative ways. The sale of shares by an insider could be seen as a vote of confidence in the company, potentially leading to increased investor interest. Additionally, the successful public offering in Dubai could signal growth opportunities for HSBC in the region.

On the other hand, the issuance of senior unsecured notes could also be interpreted as a need for capital, which might raise concerns among investors about the company’s financial stability. It’s important for investors to closely monitor these developments and consider how they might affect the stock price in the short and long term.

In conclusion, while the recent news for HSBC Holdings plc has the potential to impact the stock price, it’s essential for investors to conduct thorough research and analysis before making any investment decisions. Keeping an eye on both the positive and negative factors influencing the stock can help investors make informed choices and navigate market volatility effectively.