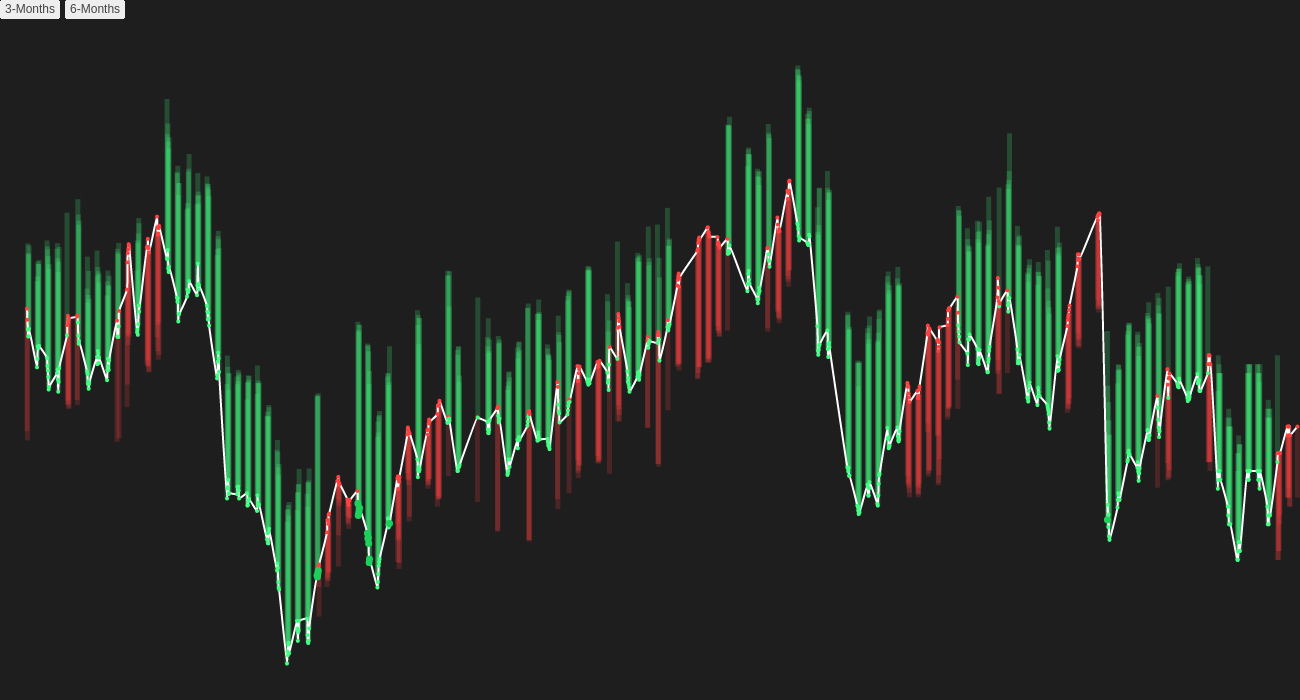

HSBC stock has been on a downward trend recently, with the current price at 39.8. The weekly forecast shows a -4.1% decrease, while the monthly forecast indicates a -3.5% decline.

Stock AI forecasts:

– Monthly: 🟥-3.5%

– Weekly: 🟥-4.1%

In recent news, HSBC led the London market lower after reporting an 80% drop in quarterly profits due to a $3 billion hit to its operations in China. This news has had a significant impact on the stock price, causing it to decrease further. Additionally, Nvidia, a U.S. chip maker, also experienced a decline in its stock price, which could be impacting the overall market sentiment.

Investors in multi-car brand giant Stellantis, however, are experiencing a positive trend as the company’s stock continues to perform well. This could potentially offset some of the losses seen in HSBC and other related stocks.

The sell-off in Adani Group stocks has intensified, with all 10 Adani counters trading in the red and erasing around Rs 90,000 crore off their combined market value. This negative sentiment in the market could be contributing to the downward trend in HSBC stock as well.

Looking ahead, it will be important to monitor any further developments in the global market that could impact HSBC stock. The company’s performance in China and any updates on its operations there will be key factors to watch. Additionally, keeping an eye on the overall market sentiment and any geopolitical events that could influence investor behavior will be crucial in forecasting the future price movement of HSBC stock.