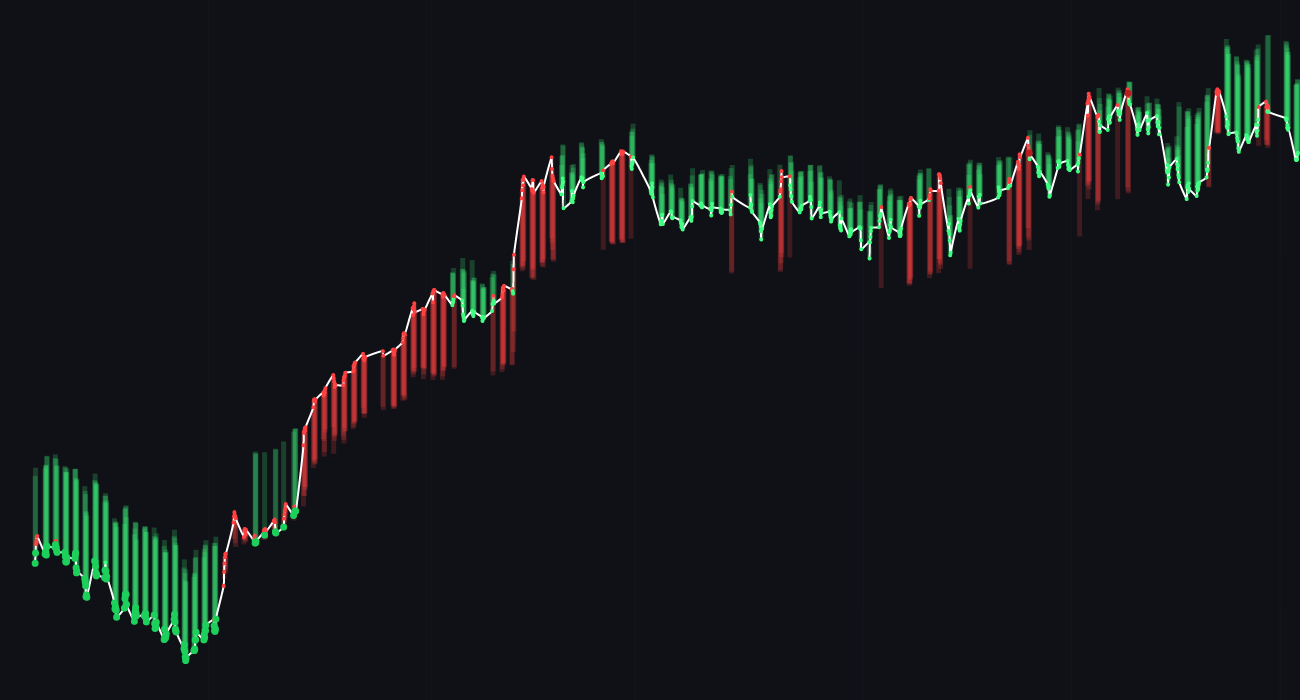

BLK-BlackRock, Inc. stock has been on an upward trend recently, with the current price at 815.6. The stock has a positive short-term forecast of +9.8% and a monthly forecast of +3.8%, indicating potential growth in the coming weeks.

Forecast table:

– Short-term forecast: 🟢 +9.8%

– Monthly forecast: 🟢 +3.8%

Recent news:

🔴 BlackRock, Inc. CEO Laurence Fink sold 30,978 shares of the firm’s stock, which could impact investor sentiment.

🟢 Raleigh Capital Management Inc. increased its holdings in BlackRock, Inc., a positive sign for the stock.

🔴 BlackRock, Inc. saw a large growth in short interest during February, which could lead to increased volatility in the stock.

🟢 Wedmont Private Capital increased its position in BlackRock, Inc., signaling confidence in the stock.

🔴 Abacus Planning Group Inc. grew its stake in BlackRock, Inc., potentially indicating a bearish outlook.

🟢 Creative Planning boosted its holdings in BlackRock, Inc., showing continued interest in the stock.

🔴 Ritholtz Wealth Management cut its position in BlackRock, Inc., which could be seen as a negative signal.

🟢 Raymond James Financial Services Advisors Inc. lifted its position in BlackRock, Inc., a positive sign for the stock.

🔴 Claro Advisors LLC decreased its stake in BlackRock, Inc., which could lead to a dip in the stock price.

🟢 Capital Investment Advisors LLC trimmed its holdings in BlackRock, Inc., possibly indicating a cautious approach.

The recent news surrounding BlackRock, Inc. stock has been mixed, with some investors increasing their positions while others are reducing their stakes. The sale of shares by the CEO could impact the stock price in the short term, but the overall positive sentiment from other investors could help support the stock price. It will be important to monitor how these developments play out in the coming weeks to determine the true impact on the stock price.