Baidu (NASDAQ:BIDU) downgraded to hold, impacting stock price.

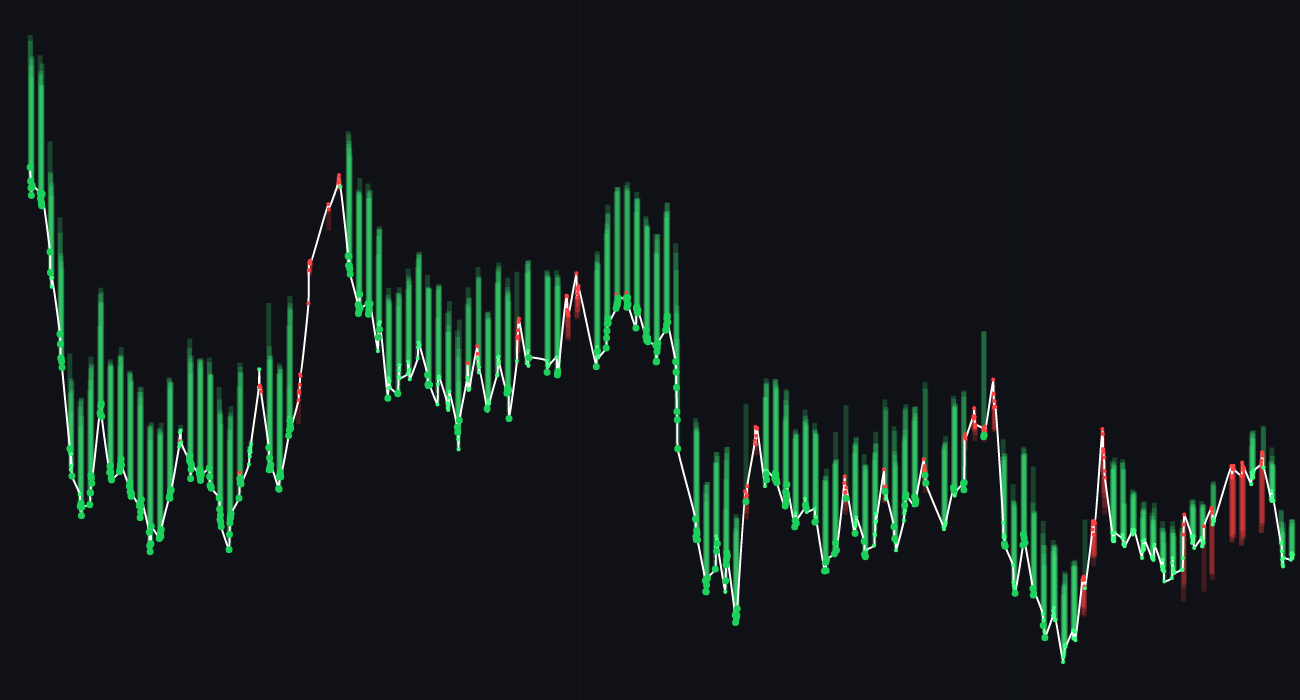

Stock AI predicts a 🔴 -2.2% short-term decrease and a 🟢 +2.0% long-term increase for BIDU.

🔴 Baidu faces antitrust probe in China for its dominant market position in online search engines.

🟢 Baidu announces partnership with a leading autonomous driving company to develop driverless technology.

🔴 Baidu reports lower-than-expected earnings for the quarter, citing increased competition in the tech sector.

🟢 Baidu launches a new cloud computing service, expanding its offerings in the rapidly growing market.

🔴 Baidu faces backlash for privacy concerns related to its data collection practices.

🟢 Baidu receives approval to list its shares on the Hong Kong Stock Exchange.

Baidu, Inc. has recently been in the news for a mix of positive and negative developments. The antitrust probe in China has raised concerns about the company’s market dominance, leading to a potential decrease in investor confidence and a negative impact on the stock price. Additionally, the lower-than-expected earnings report has also contributed to a bearish sentiment around the stock.

On the positive side, Baidu’s partnership in developing autonomous driving technology and the launch of a new cloud computing service have been seen as promising growth opportunities. These developments have sparked investor interest and could potentially lead to an increase in the stock price in the long term.

Overall, the recent news surrounding Baidu has created a mixed outlook for the stock. While challenges such as the antitrust probe and privacy concerns may weigh on the price in the short term, the company’s strategic partnerships and expansion into new markets could drive growth and lead to a positive long-term forecast. Investors should closely monitor these developments and consider the potential impact on Baidu’s stock price.