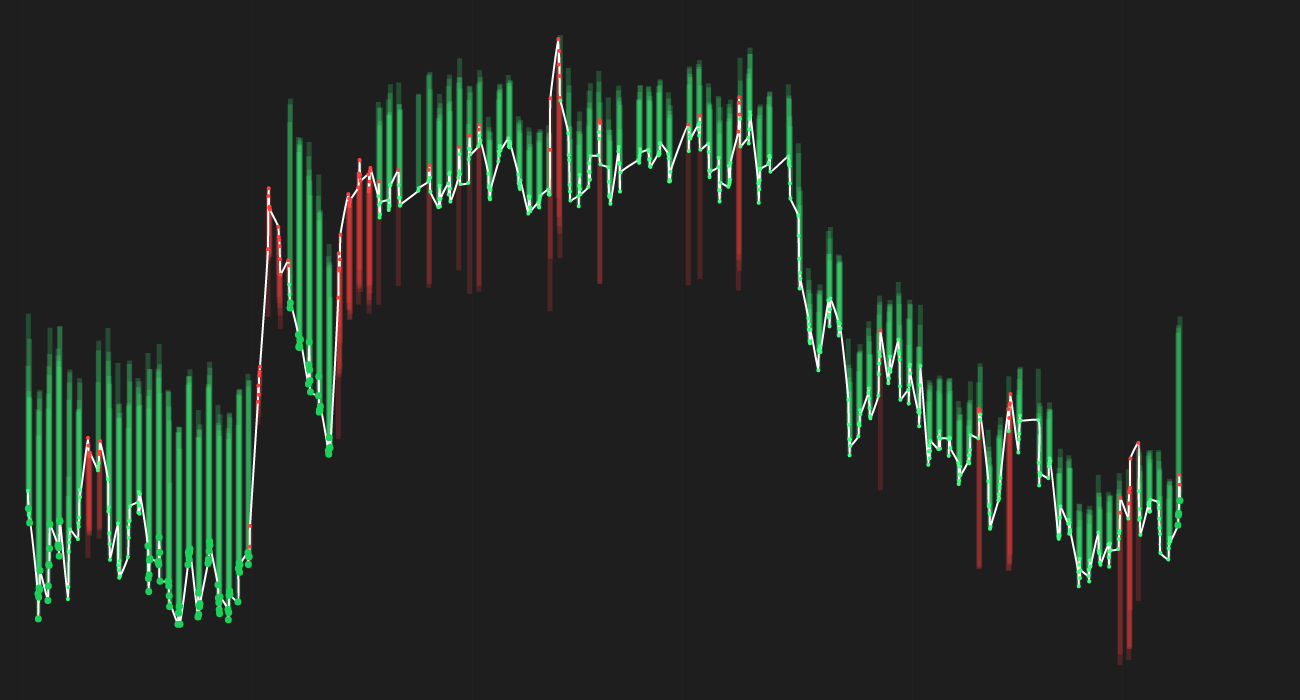

American Water Works Company, Inc. (NYSE: AWK) has been showing a positive trend recently, with the current price at 120.4. Analysts are predicting a weekly forecast of +4.6% and a monthly forecast of +3.7%.

Forecast:

– Weekly Forecast: 🟢 +4.6%

– Monthly Forecast: 🟢 +3.7%

Recent News:

– 🔴 American Water Works Company, Inc. EVP Melanie M. Kennedy sold 843 shares of the business’s stock, potentially indicating a lack of confidence in the company’s future prospects.

– 🟢 O Shaughnessy Asset Management LLC increased its position in American Water Works Company, Inc., suggesting a positive outlook on the stock.

– 🔴 Schroder Investment Management Group trimmed its position in the company, possibly signaling a bearish sentiment.

– 🟢 Schonfeld Strategic Advisors LLC significantly increased its holdings in American Water Works Company, Inc., indicating a bullish stance.

– 🟢 Exchange Traded Concepts LLC also grew its holdings in the company, showing confidence in its performance.

– 🔴 Mutual Advisors LLC decreased its position in American Water Works Company, Inc., which could lead to some downward pressure on the stock.

– 🟢 Lazard Asset Management LLC significantly raised its stake in the company, suggesting a positive outlook.

– 🔴 Cornerstone Wealth Management LLC reduced its stake in the company, potentially signaling a lack of confidence in its future prospects.

– 🟢 Qube Research & Technologies Ltd bought a new position in the company, indicating a positive sentiment towards its performance.

– 🟢 Mariner LLC increased its holdings in American Water Works Company, Inc., showing confidence in the stock’s potential.

Effect on Price:

The recent news surrounding American Water Works Company, Inc. stock has been a mix of positive and negative signals. While some institutions have increased their holdings and shown confidence in the company’s future performance, others have reduced their positions or sold shares. This could create some volatility in the stock price in the short term. Investors should closely monitor any further developments and consider the overall sentiment towards the stock before making any investment decisions.