HSBC bullish on AMD, Broadcom faces profitability challenge. Insider selling activity noted.

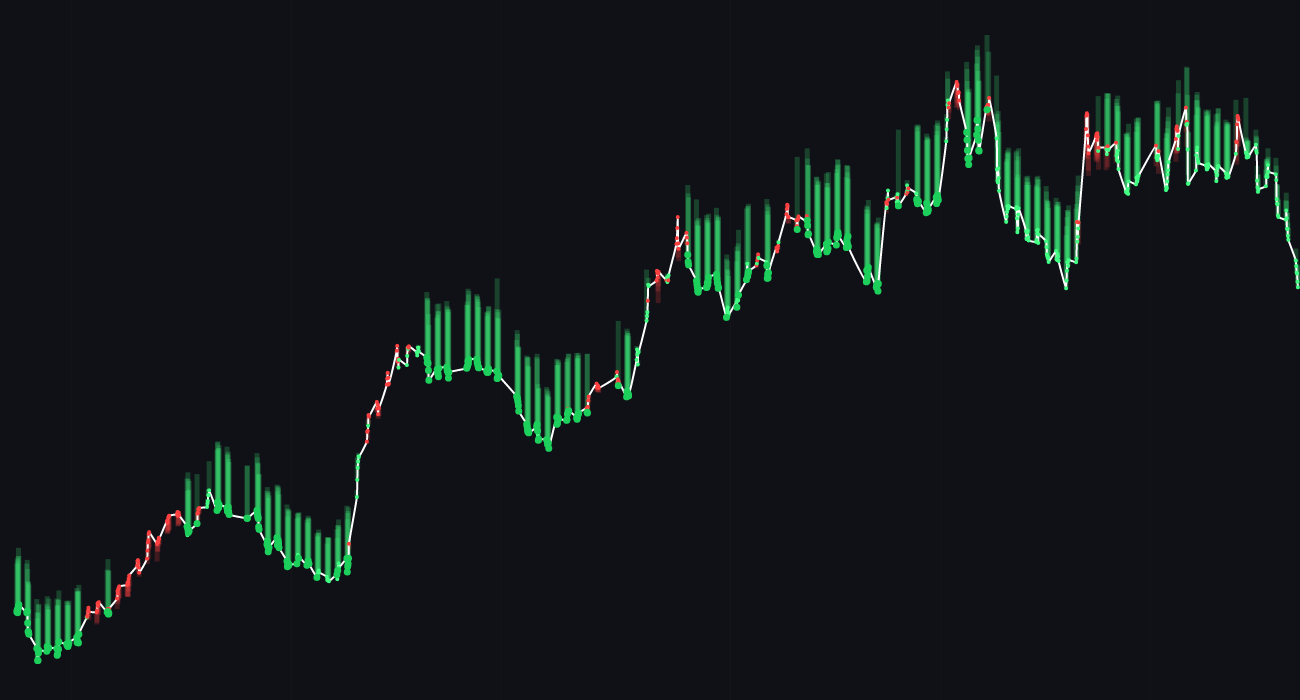

🔴 Short-term forecast: (-0.6%)

🟢 Long-term forecast: (+1.2%)

Stock AI’s (AVGO) Forecast get (+27.9% Profit)

StockAI’s analysis delivers real-world results. On 17 January 2024, $AVGO ($1096.02), StockAI predicted a long-term 🟢 buy signal. It was accurate: 1 month later price increased to $1402.3 (🟢27.9%). Buying AVGO on this signal yielded a +27.9% profit 💰💰.

AVGO-Broadcom Inc. News

🟢 HSBC turns bullish on AMD shares, saying there won’t just be one winner in the market for AI GPUs. This positive sentiment could lead to increased investor confidence in the semiconductor industry, including Broadcom.

🔴 Several brokerages have updated their recommendations and price targets on shares of Broadcom in the last few weeks. This mixed bag of opinions could create uncertainty in the market and potentially lead to fluctuations in Broadcom’s stock price.

🟢 Broadcom Inc. Director Kenneth Hao sold 9,160 shares of the business’s stock, indicating insider confidence in the company’s future. This could signal to other investors that leadership believes in the company’s growth prospects.

🔴 Barclays started coverage on shares of Broadcom with an overweight rating. This new coverage could bring increased attention to Broadcom, but it also introduces a level of uncertainty as investors digest the new information.

🟢 Broadcom Inc. CEO Hock E. Tan sold 2,000 shares of the stock, showcasing leadership’s commitment to the company’s success. This move could instill confidence in investors and potentially lead to a positive impact on Broadcom’s stock price.

🔴 Broadcom Inc. CFO Kirsten M. Spears sold 3,000 shares of the firm’s stock, which could be interpreted as a lack of confidence in the company’s future performance. This insider selling may raise concerns among investors and lead to a negative impact on Broadcom’s stock price.

Broadcom Inc. (AVGO) has been the subject of various news and developments in recent weeks, ranging from insider selling to analyst recommendations. These events have the potential to impact the stock price in both positive and negative ways. Investors should closely monitor these updates to make informed decisions about their investments in Broadcom. Each piece of news, whether positive or negative, can influence market sentiment and contribute to the overall performance of the stock. It is essential for investors to consider all available information and assess the potential implications on AVGO’s stock price before making any trading decisions.

AVGO-Broadcom Inc. Analyst Ratings

Analyst Ratings for Broadcom Inc. Stock

📈 JPMorgan Chase & Co. reaffirmed their “overweight” rating on Broadcom (NASDAQ: AVGO) stock.

📈 Deutsche Bank Aktiengesellschaft reiterated their “buy” rating on Broadcom (NASDAQ: AVGO) shares.

📈 Benchmark analysts maintained their “buy” rating on Broadcom (NASDAQ: AVGO) stock.

Sources

– MarketWatch

– Yahoo Finance

– Forbes

– ETF Daily News

– ETF Daily News

Disclaimer

Investors may consider the AI predictions and news summaries as one factor in their investment decisions alongside their own research and risk tolerance.