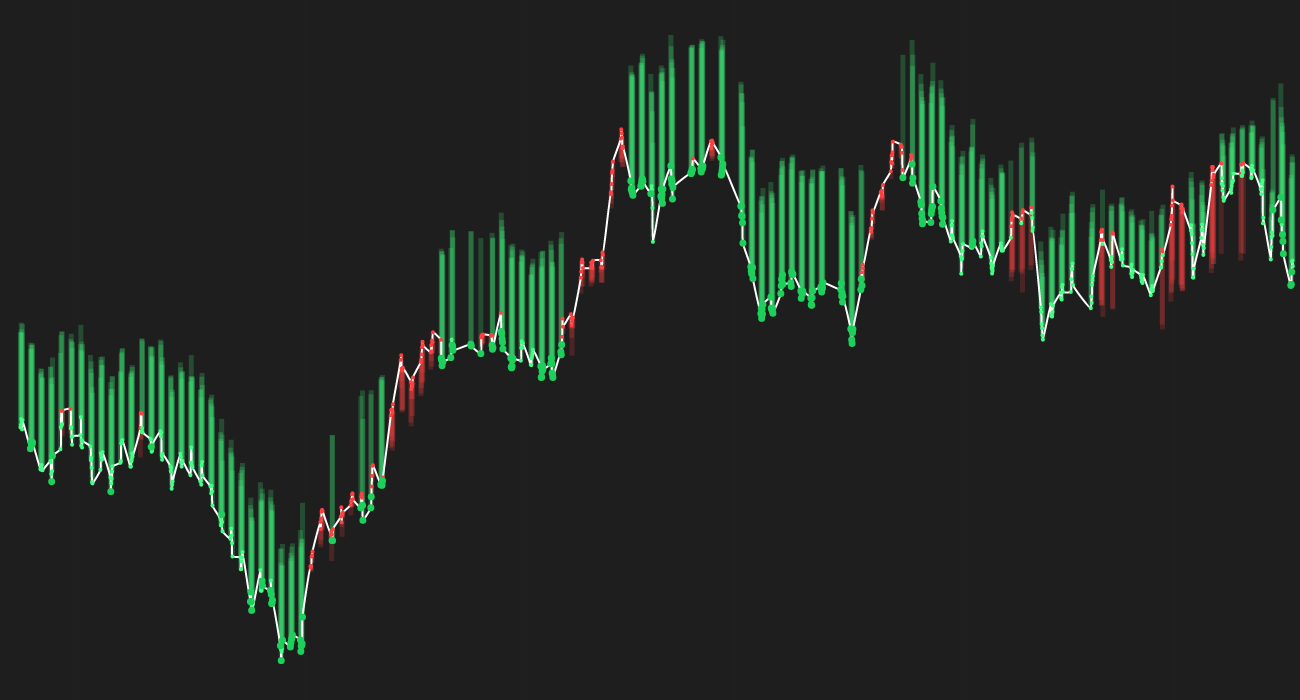

Analog Devices, Inc. (ADI) has been making headlines recently with various updates and developments that could potentially impact its stock price. The current price of ADI is 175.8, with a weekly forecast of (-0.4%) and a monthly forecast of (+4.8%).

Stock AI forecasts:

– Monthly: 🟢 +4.8%

– Weekly: 🔴 (-0.4%)

Recent news for ADI includes a number of rating reaffirmations and target price adjustments from various firms. Cantor Fitzgerald reaffirmed their neutral rating on ADI, while Morgan Stanley reissued their overweight rating. Truist Financial decreased ADI’s target price, and Wesbanco Bank Inc. reduced its stake in the company by 0.9%.

The impact of these news updates on ADI’s stock price can vary. Rating reaffirmations and target price adjustments can influence investor sentiment and trading activity. For example, a neutral rating reaffirmation may signal stability, while an overweight rating reissue could indicate optimism about the company’s future performance. On the other hand, a decrease in target price or reduction in stake by a major investor may lead to selling pressure and a potential decrease in stock price.

In the case of ADI, the recent news suggests a mixed outlook for the stock. While some firms are maintaining their ratings and price targets, others are adjusting their positions. It will be important for investors to monitor these developments closely and consider how they may impact ADI’s stock price in the short and long term.

Overall, the news surrounding ADI indicates a level of uncertainty and potential volatility in the stock. Investors should stay informed and be prepared for potential price fluctuations based on market reactions to the latest updates.