Apple Inc (NASDAQ:AAPL) is currently facing a temporary 9.0% decrease in its stock price, but Stock AI predicts a positive 0.9% increase in the long-term forecast. 🟥🟢

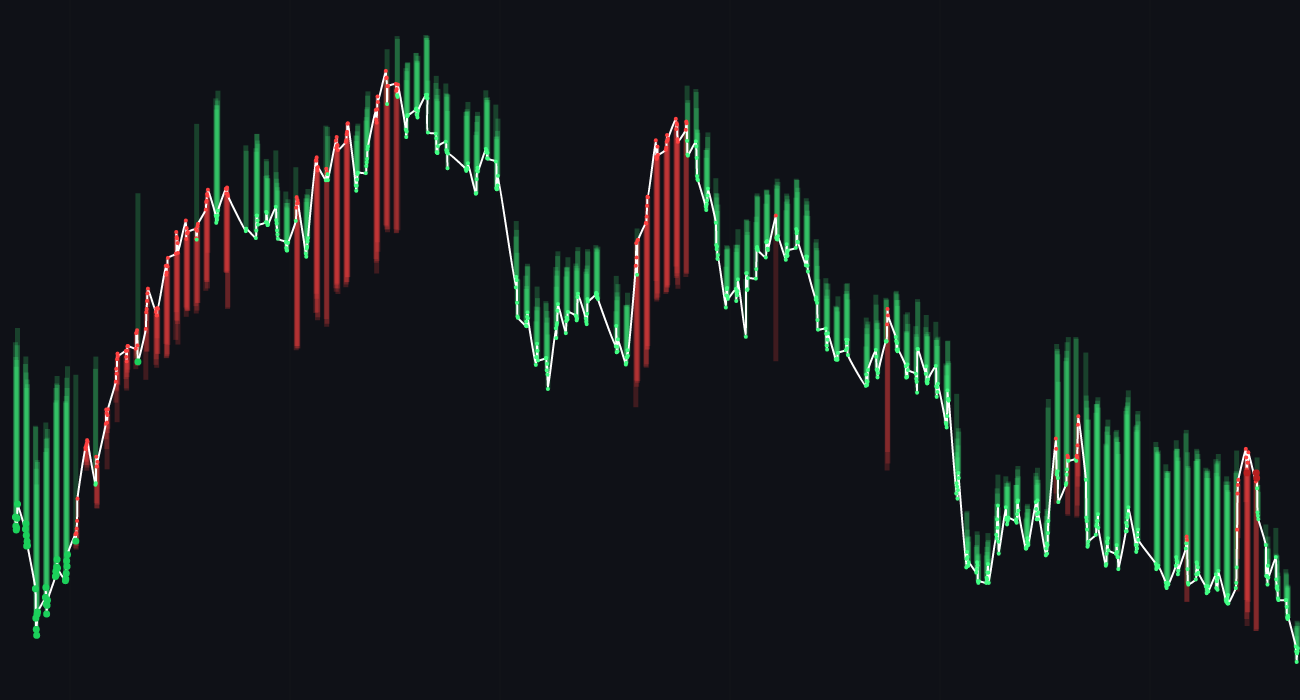

Stock AI’s (AAPL) Forecast get (+12.9% Profit)

StockAI’s analysis delivers real-world results. On 22 January 2024, $AAPL ($194.75), StockAI predicted a long-term 🔴 sell signal. It was accurate: 1 month later price dropped to $169.6 (🔴-12.9%). Selling AAPL on this signal yielded a +12.9% profit 💰💰.

AAPL-Apple Inc. News

🟢 Apple is a world-class investor with one of the strongest brands whose stock is temporarily under pressure.

🔴 Apple had its price target lowered by analysts at Loop Capital from $185.00 to $170.00.

🔴 Apple’s stock price dropped 0.9% during mid-day trading.

🔴 Apple CFO Luca Maestri sold 53,194 shares of the business’s stock.

🔴 Apple received a number of ratings updates from brokerages and research firms.

🟢 Apple’s stock had its “outperform” rating restated by stock analysts at Wedbush.

Apple Inc. (AAPL) has been facing some challenges in the market recently, with a few negative developments such as a lowered price target and a drop in stock price. However, the company’s strong brand and positive ratings updates from some analysts provide a ray of hope for investors. The recent sale of shares by Apple’s CFO may have caused some concern, but overall, the company’s long-term forecast remains positive. Despite the short-term forecast indicating a decrease in stock price, the broader market sentiment seems to be positive towards Apple. Investors may want to keep a close eye on the stock and consider the long-term potential of this world-class technology company.

AAPL-Apple Inc. Analyst Ratings

📉 Loop Capital lowered their price target on Apple Inc. (NASDAQ:AAPL) stock from $185.00 to $170.00 and maintained a “hold” rating on the stock.

📉 Wedbush reiterated their “outperform” rating on Apple Inc. (NASDAQ:AAPL) stock with a price target of $250.00.

📉 Abacus Planning Group Inc. decreased their position in Apple Inc. (NASDAQ:AAPL) stock by 4.5% in the fourth quarter.

Sources:

1. ETF Daily News – Holdings Cut by Westside Investment Management Inc.

2. ETF Daily News – Shares Sold by Lakewood Asset Management LLC

3. ETF Daily News – COO Sells Shares of Stock

4. ETF Daily News – Holdings in Apple Inc.

5. ETF Daily News – Wealth Management Inc. Sells Shares

Disclaimer

Investors may consider the AI predictions and news summaries as one factor in their investment decisions alongside their own research and risk tolerance.